Impact of the consumption tax hike in Japan on Real Estate

- Japanese real estate expertise

2019 is a year with many changes.

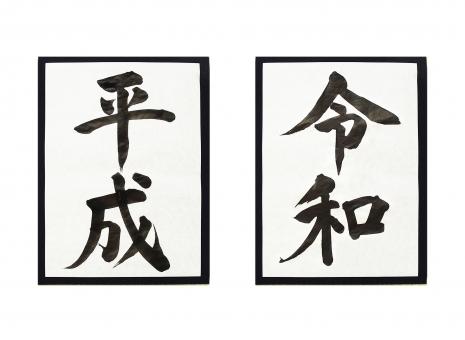

On 1st May 2019, the Imperial era has changed from "Heisei" to "Reiwa".

A further change is... "The Consumption tax hike"! We would like to talk about the impact of the consumption tax hike on real estate in this edition.

■ When will the consumption tax be increased?

The consumption tax in Japan will be increased from 8% to 10% in October 2019.

~ History of Consumption Tax~

| Japanese calendar | Western calendar | Prime Minister | Event |

| 1st year of Heisei | 1989 | Noboru Takeshita climbing |

EnforcementFrom of thethe enforcement date of Consumption Tax Act from 1st April. Consumption tax at 3% startsIt was introduced at a rate of 3% consumption tax. |

| 9th year of Heisei | 1997 | Ryutaro Hashimoto | Increased in consumption tax to 5% |

| 26th year of Heisei | 2014 | Shinzo Abe | Increased in consumption tax to 8% |

| 1st year of Reiwa | 2019 | Shinzo Abe | Consumption Tax will be increased to 10% in October. |

This table shows that the tax rate has increased by 7% over the last 30 years.

Prior to the tax hike, consumption of goods will be temporarily increased significantly.

This is because of the last-minute demand by consumer prior to the tax hike.

On the other hand, the government is considering some measures to avoid a negative reaction such as slowdown in purchases after the tax hike.

■ To raise the consumption tax to 10% or to be maintained at 8%

★ Items subject to reduced tax rate

① Foods and drinks…Except alcoholic beverages and dining-out

※ Take away items are basically subject to 8% (reduced tax rate), however eating and drinking in restaurants, cafes, etc. are subject to 10% (standard tax rate)

② Newspaper…8% (reduced tax rate).

※ Newspaper means published twice or more per week (under subscription agreements)

Reduced tax rate (8%) is applied to specific items based on the principle of "reducing the consumption tax burden on items that are consumed and utilized by consumers from a wide range of daily lives" in order to prevent the increase in consumption tax from the increase in the burden by the lower income group than the higher income group (regressivity).

■ Attention to tourists! Do you know any other taxes in Japan!?

① Departure tax

Effective from 7th January 2019, regardless of their nationality, all passengers from Japan to overseas will be charged JPY 1,000 as the Departure tax.

② Accommodation tax

From 2019, accommodation tax will be charged if accommodation fees exceed JPY 7,000. The tax rate may vary depend on the cities.

③ Bathing tax

If you stay at a hot spring hotel, JPY 150 per person per day (standard) will be taxed. This is taxable since 1978, and is mainly required for the development of environmental sanitation facilities and facilities for the protection and management of mining sources.

Periodic and long-term visitors may consider renting a monthly stay apartment or purchasing a second home for short-term stay if accommodation taxes, etc. are taken into account.

■ Impact of the consumption tax hike on property purchases

What kind of impact do you think the next consumption tax hike will have?

Based on what actually happened due to the consumption tax hike last time, there is no doubt that there will be an increase in the number and value of real estate in the market.

E.g. Buying of a new property with a purchase price at JPY 35,000,000.

If the Land price is at JPY 10,000,000 and the Building price at JPY 25,000,000.

When buying and selling real estate property in Japan, the consumption tax is taxed only on the Building, not on the Land.

Therefore, "Building price" shall be subject to taxation and shall be calculated.

JPY 25,000,000 × 8% tax rate = JPY 2,000,000 → JPY 27,000,000

JPY 25,000 000 × 10% tax rate = JPY 2,500,000 → JPY 27,500,000

The difference is approximately JPY 500,000!

The difference of JPY 500,000 affects the miscellaneous expenses necessary to purchase a new property. Miscellaneous expenses such as Fixed assets tax, Urban planning tax, Stamp duty, Management fund, Sinking fund, Non-life insurance premiums (fire and earthquake), Registration fee are required to pay approximately JPY 600,000 per unit. Consumption tax may be imposed on some of miscellaneous expenses, so it is necessary to consider more expenses than expected.

Considering the above, the consumption tax hike has a significant impact on expenditures as well.

The consumption tax is imposed on the sale and purchase of housing and the construction of new housing at the time of hand over. Therefore, even if the agreement is signed on or before 30th September 2019, if the Handover day is on or after 1st October 2019, the new consumption tax rate which is 10% will be applied. However, as a transitional measure, the old tax rate shall apply to ordered housing, etc. ※ The terms and exceptions may vary.

After the consumption tax hike, there may be concerns about the downturn in the economy. On the other hand, the Olympic and Paralympic Games Tokyo 2020 will bring much more tourists to Japan. As a result, Japan’s economic growth rate is expected to increase overall as well, including food service, tourism, and retailing. In recent years, many redevelopments are being carried out frequently in Tokyo and the opening of the Linear Shinkansen after the Olympics and Paralympics is also expected to make Tokyo more liven-up in the future.