【Why Japanese people buy real estate now】and【Japanese real estate seen from overseas】

- Japanese real estate expertise

【Why Japanese people buy real estate now】and【Japanese real estate seen from overseas】

This article explains why Japanese people add real estate to their personal portfolios. First, let's take a look at the current situation in Japan through objective "numbers."

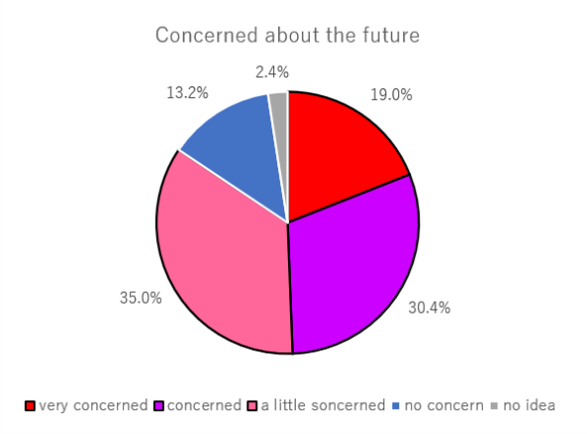

1. Concerned about the future

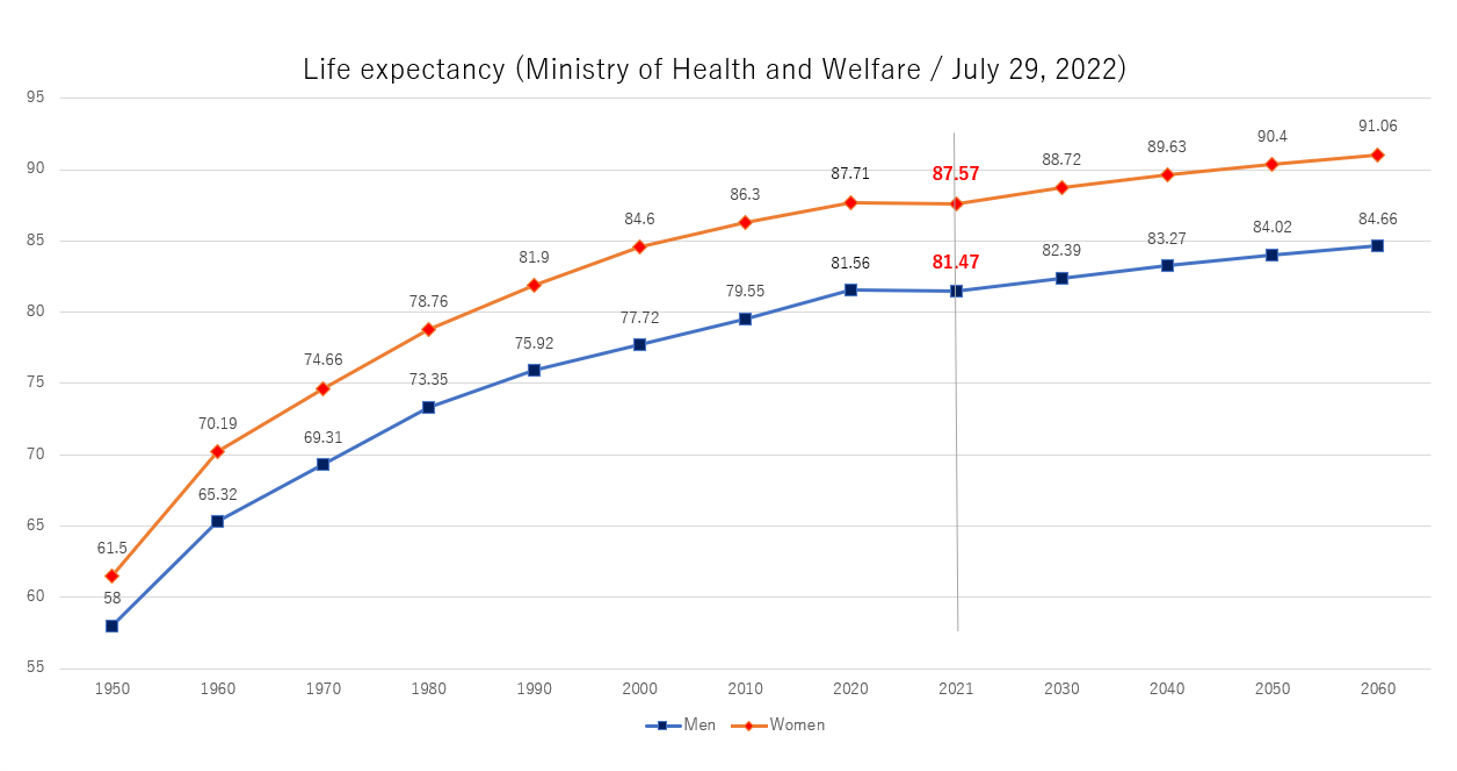

Japan ranks first in the world as a country with the longest average life expectancy for both men and women.

According to the Ministry of Health, Labor and Welfare's announcement on July 29, 2022, the average life expectancy for Japanese women was 87.57 years and the average life expectancy for Japanese men was 81.47 years.

Pension system reform has been a long-standing issue in Japan, as people are required to plan their lives up to the age of 100, assuming "100-year lifespans ".

According to a survey on livelihood security conducted by the World Health and Cultural Center, over 80% of people answered that they are concerned about their own lives after retirement.

* (Public Interest Incorporated Foundation) World Insurance Cultural Center 2019

“Survey on Livelihood Security”

[Survey results]

People who are very concerned: 19%

People who are concerned: 30.4%

People who are a little concerned: 35%

Total people who are concerned: 84.4%

New pension rules have been applied since April 2021.

The payment for the national pension and employees' pension has been reduced in 2021 and 2022 since the rate of increase in wages is lower than the rate of increase in prices then.

More and more people need government assistance for their livelihoods.

Of course, there must be many people who are concerned about their own lives after retirement due to more inflation.

【What is the actual situation?】

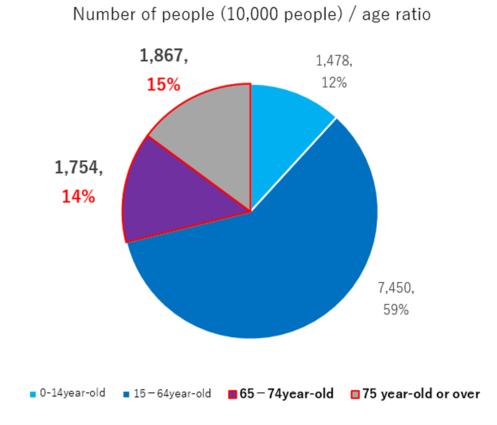

According to the annual report "Aging Society White Paper 2022 " submitted by the government to the Diet, the population aged 65 and over is 36.21 million, accounting for 28.9% of the total population.

With an aging population, a shrinking workforce, declining productivity and growing health concerns for individuals, spouses and parents, the issue of retirement income and pensions is more important.

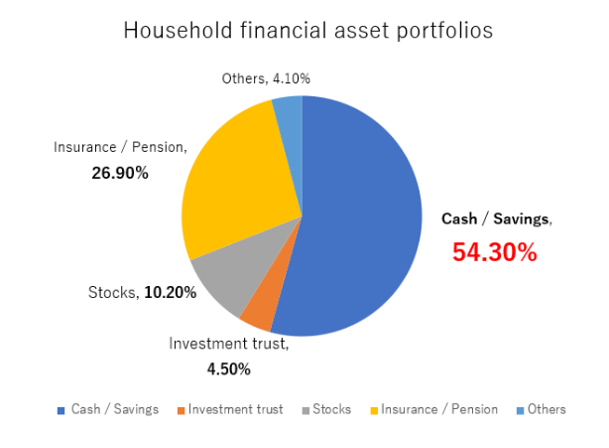

2. Imbalances in household financial asset portfolios

According to the "Flow of Funds in the First Quarter of 2022

" released by the Research and Statistics Department of the Bank of Japan on June 27, 2022,

cash and deposits account for 54.3% of the financial asset portfolio of Japanese households, and insurance and pensions account for 26.9%,

stocks and investment trusts accounted for 14.7%, indicating that Japanese people are "conservative.

"

【What to do about it ?】

The government is calling for a "shifting from savings to investment

" and "shifting income after retirement from public-help to self-help.

"

To increase investment incentives, the government provides all kinds of tax deduction and assistance.

For example,

“Small investment tax exemption system (NISA, savings NISA, junior NISA, new NISA)” that exempts capital gain tax and dividend tax.

“Corporate Defined Contribution Pension, Individual Defined Contribution Pension (iDeCo)”

that exempts capital gain tax and dividend tax in addition to deduction for income tax and resident tax.

In particular, housing has a large effect on the economy, so tax measures have been taken to stimulate housing investment.

●Housing subsidy

●Income tax deduction by housing acquisition (housing mortgage)

●Tax deductions when purchasing or owning house, such as fixed asset tax, registration tax, and acquisition tax

●Gift tax exemption for housing acquisition

●Housing mortgage "Flat 35" / preferential interest rate

By adding real estate to your financial asset portfolio, you can have not only a real asset but also stable income by leasing it.

Rent income is “stable” and “easy to plan” for you.

It is one of the asset managements that not only Japanese but also people with different lifestyles are interested in regardless of nationality.

3. Growing domestic demand and Excitement of overseas investors

①Different roles of real estate depending on the times

■Middle-aged (30s to 40s) consider “low risk, long return

”:

They are making money at their current job and have enough time to make choices and decisions.

Real estate has various benefits such as using mortgage and tax savings, but many people prepare for future income by holding stable assets.

■"Asset protection

" for older people:

Its purpose is not only to increase wealth, but also to protect existing assets.

High-return investments such as stocks have "a shorter recovery time in the event of a loss'' for older people.

Since real estate is less susceptible to economic fluctuations, many people own real estate to "protect their assets.

"

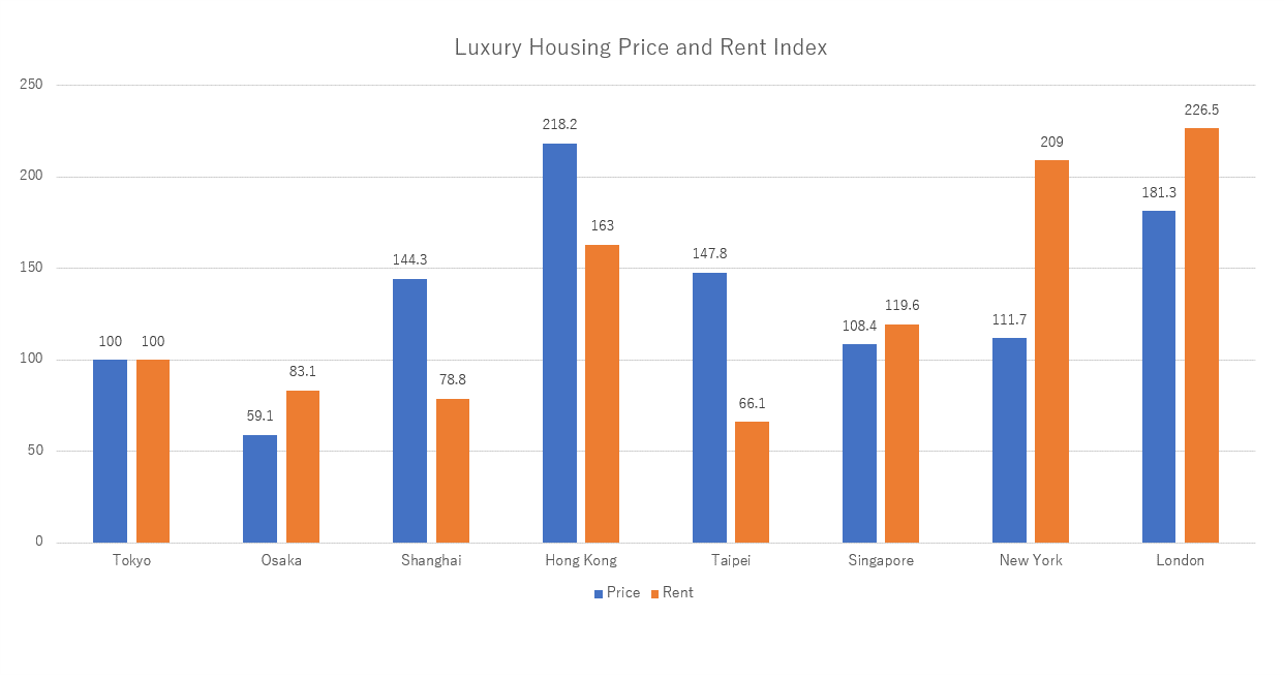

②Reasonable prices compared to major cities in other countries

According to the "Survey results of the international real estate price and rent index (as of April 2022)" released by the Japan Real Estate Institute on May 30, 2022, if the index of Tokyo (Motoazabu, Minato-ku) is 100,

■New York:111.7,

■Shanghai:144.3,

■Taipei:147.8,

■London:181.3,

■Hong Kong:218.2.

Concerns about inflationary trends and rising construction costs appear to be driving prices higher, especially in Taipei (4.0% price volatility) and New York (5.5% price volatility).

※Source: Japan Real Estate Institute "International Real Estate Price and Rent Index"

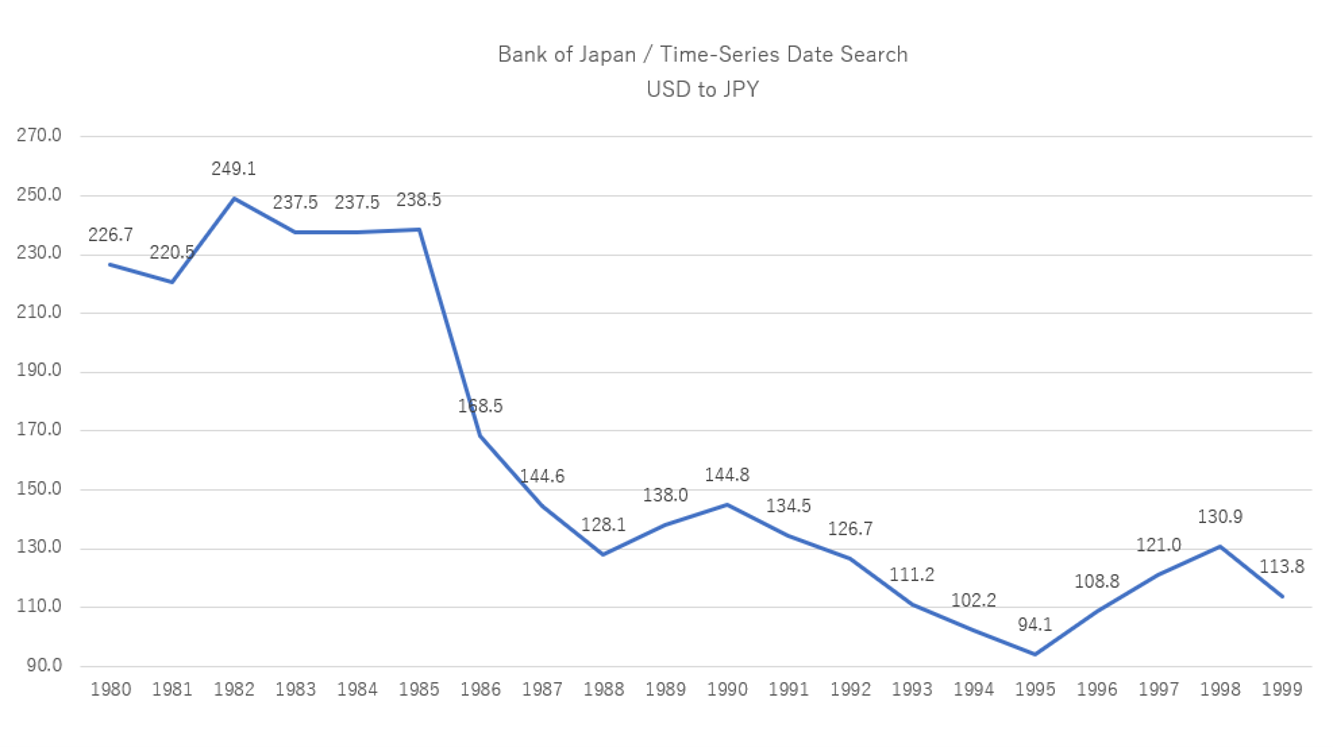

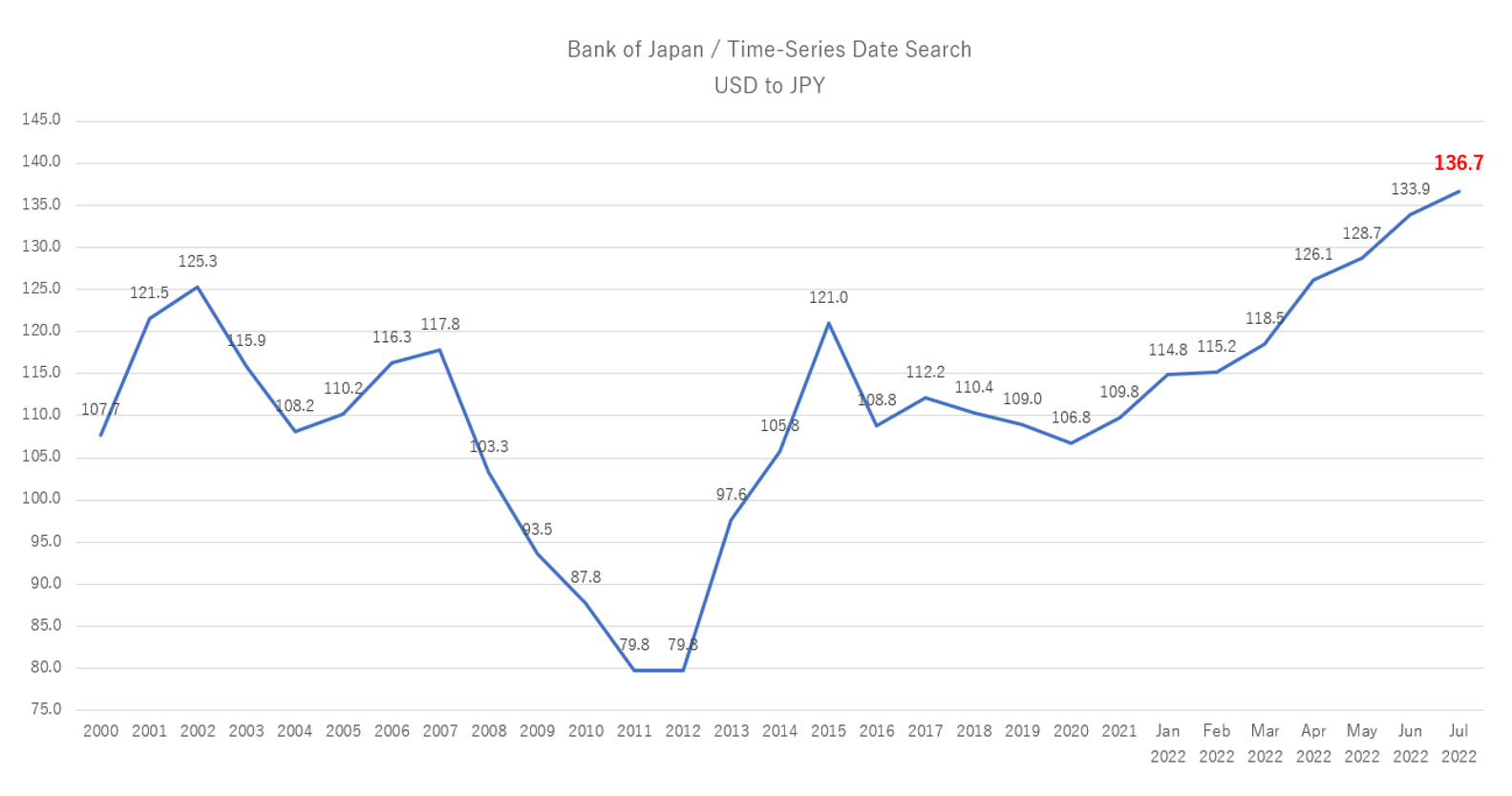

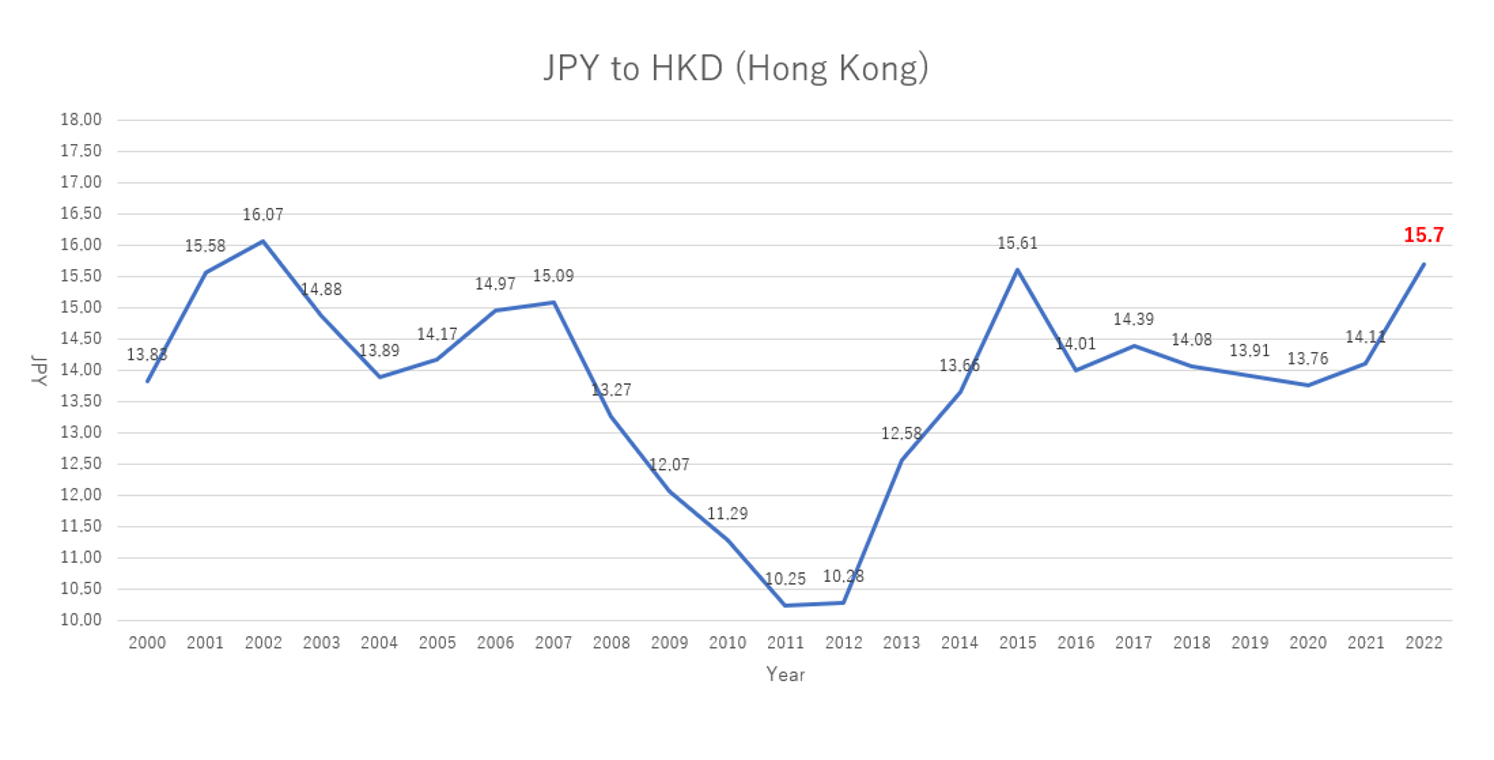

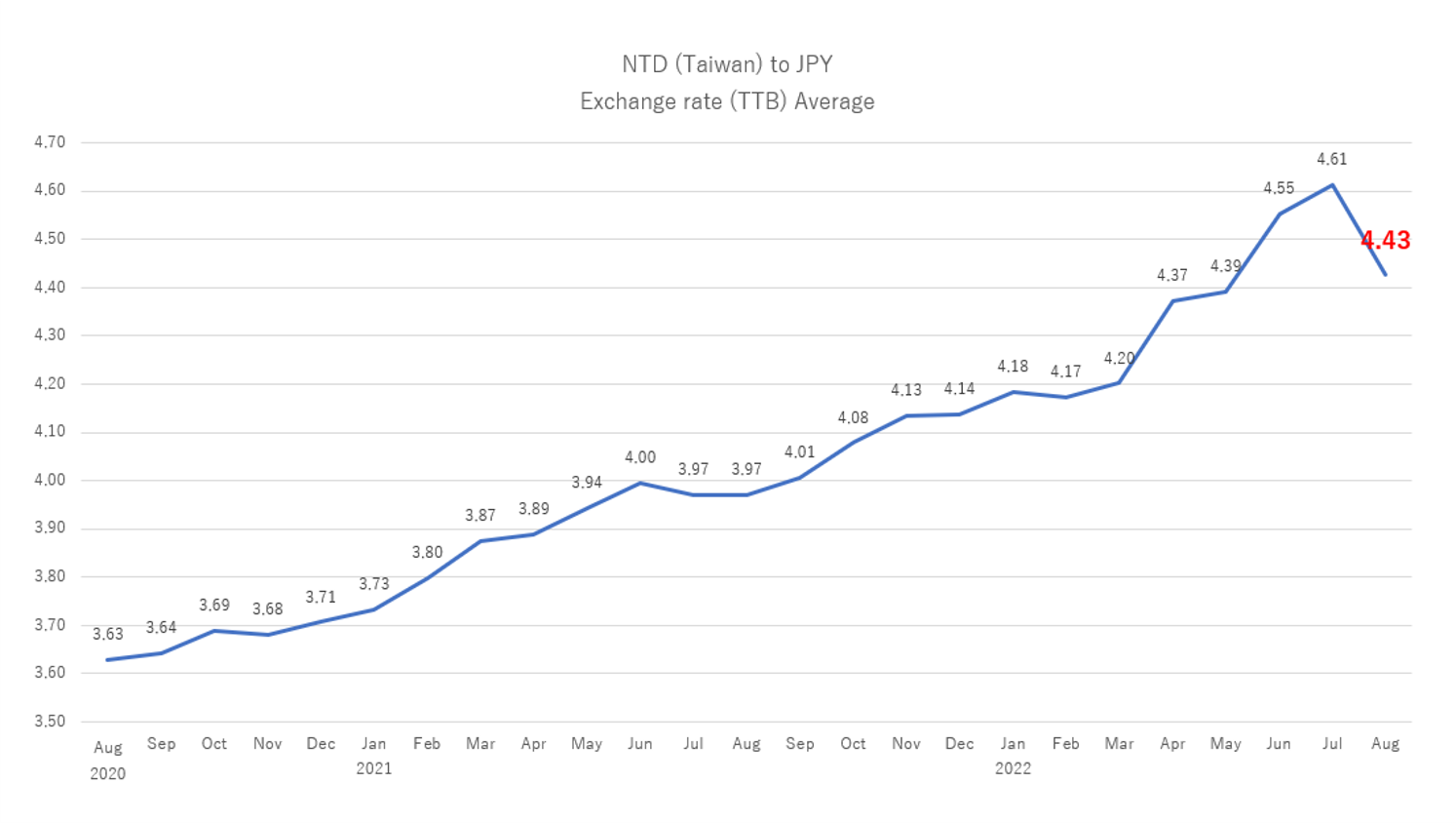

③ Impact of JPY depreciation

The JPY is depreciating due to the interest rate difference between Japan and the U.S, and the average exchange rate from April to June 2022 is 1 USD = almost 130 JPY, which is about 20 yen lower than the same period last year.

According to CBRE's "Japan's Inbound and Outbound Investment 2021 " announcement, inbound investment in 2021 was 10.3 billion USD.

In the investor awareness survey, 74% of respondents answered that the acquisition amount in 2022 will be “more than last year, ” indicating a high level of interest.

※Source: CBRE Inc. “Inbound/Outbound Investment in Japan 2021 ”

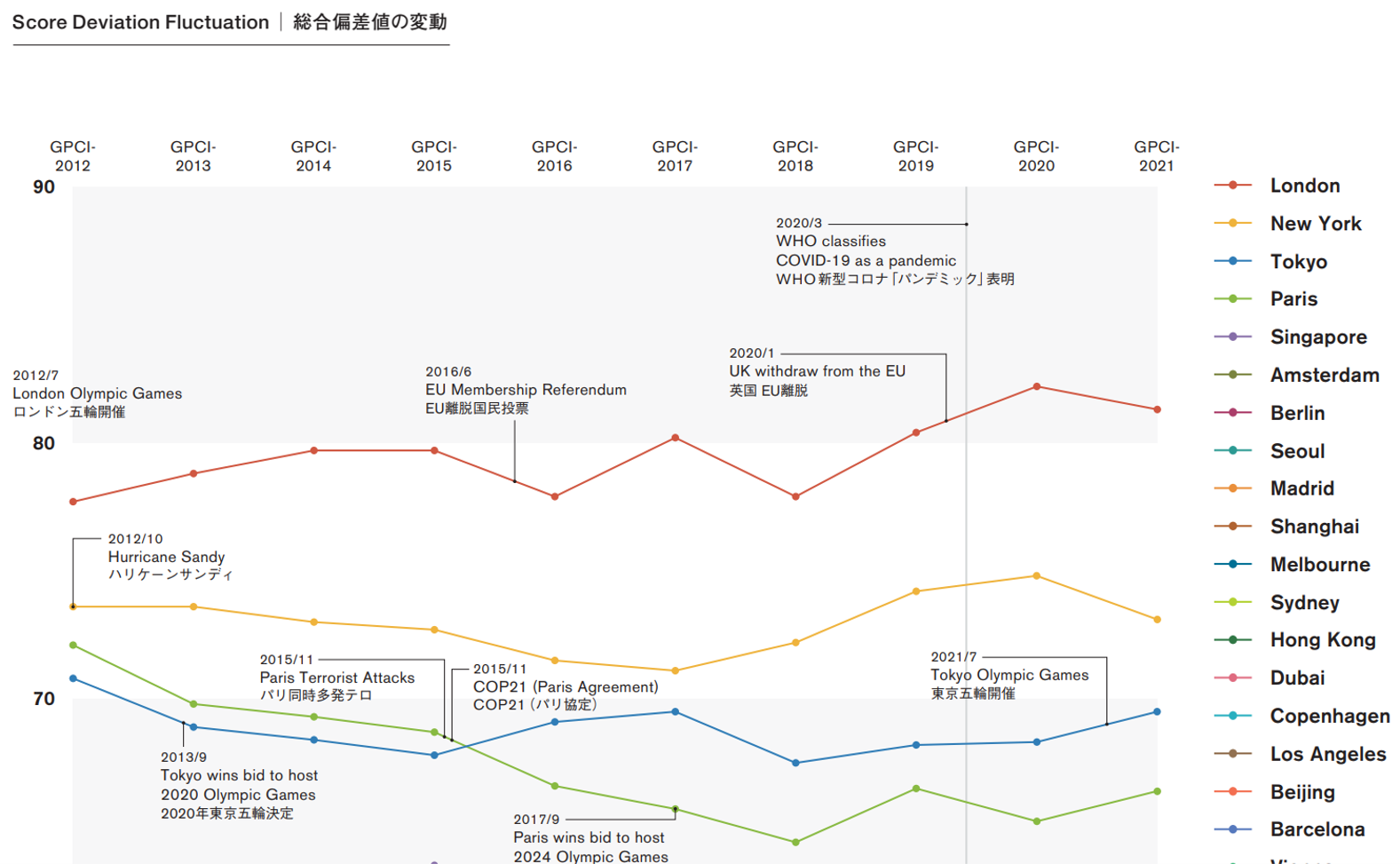

④Comprehensive strength of Tokyo and legal development

Since 2008, the Institute for Urban Strategies of the Mori Memorial Foundation has evaluated and ranked 48 cities around the world every year.

In 2021, Tokyo

was third.

Overall, Tokyo was highly evaluated and well-balanced.

※Source: Mori Memorial Foundation, Institute for Urban Strategies

Interest in real estate in Japan is growing, not only because of its credibility as a developed country, but also because of its well-developed legal and administrative systems.

In some countries, real estate transactions can be opaque and ambiguous due to the lack of real estate valuation standards, real estate business licenses, consumer protections, etc.

In Japan, the Real Estate Transaction Business Act obliges all real estate companies that engaged in buying, selling, brokering, and leasing to be licensed in order to promote safe real estate transactions and protect general buyers.

Therefore, many people think that Japanese real estate, which is attracting overseas investors, is an “advantageous asset

”.

Real estate buyers vary by individual, such as income, asset balance, family structure, age, and investment views.

There's no one-size-fits-all answer, so let's check the pros and cons of real estate to go find the property that it's perfect for you.